The holiday shopping season is underway, which means an uptick in consumer spending. What this also means is an increase in card fraud. Whenever shoppers are spending more, fraudsters are quick to follow — which includes taking part in the holiday shopping season themselves.

The holiday shopping season is underway, which means an uptick in consumer spending. What this also means is an increase in card fraud. Whenever shoppers are spending more, fraudsters are quick to follow — which includes taking part in the holiday shopping season themselves.

Banks and credit unions are less likely to stop authorization on purchases in order to avoid creating extra friction at checkout, and fraudsters have caught onto this habit. More than ever, consumers need to be savvier and know what red flags to look for this holiday season as they partake in the holiday shopping season. Likewise, card issuers need to be equipped with the knowledge (and tools) necessary to combat holiday card fraud.

We have a few resources to help you along the way:

For consumers — learn how to protect yourself, or help your cardholders protect themselves, in our infographic: 5 Common Consumer Credit Card Scams: + 10 Tips For Protecting Yourself From Fraud.

For issuers — Download our quick-and-easy guide, Fighting Holiday Card Fraud: 10 Tips for Issuers, to help you proactively fight fraud this holiday season and beyond.

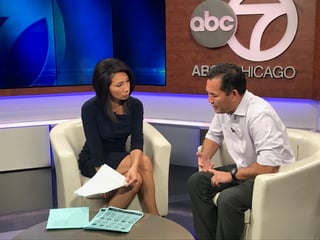

To catch the rest of these tips, catch what our Co-Founder Canh Tran had to say in his interview with ABC7 Chicago's Judy Hsu: