Banks have plenty on their holiday checklist. More than enough to check it once...or even twice. Being prepared to combat holiday card fraud means proactively preparing long before the storm hits.

The holiday season is also a busy time for fraudsters who prey on customers and financial institutions who are reluctant to decline a transaction or re-issue cards. As a refresher for 2018, we’ve brought back our team’s tips on what issuers can do to manage incidents during this peak fraud.

Throughout the year, issuers must prepare for updated decision rules, have a strategic plan for why and when they reissue cards, and have the tools to tweak KYC and ID fraud algorithms to keep up with the speed fraudsters evolve. After the holiday season, issuers should be prepared to follow-up with fraud transactions and compromised card analysis in order to perform a more targeted, efficient re-issuance process. Following the holiday season, FIs should determine where gaps exist by investing in better and faster technology tools.

But what about before the holiday fraud surge hits? Issuers must educate cardholders on making safe purchases and monitoring their cards frequently. For FIs, it’s important to implement real-time monitoring for fraudulent or unusual patterns, increase customer interactions, and minimize re-issuance disturbance.

Rising trends like synthetic ID fraud and account takeover fraud will continue to lead the list of concerns. Issuers should invest in technology that allows them to proactively detect compromises card fraud — and the source of data breaches — better and more accurately in order to stop fraud faster, save money and lessen customer impact.

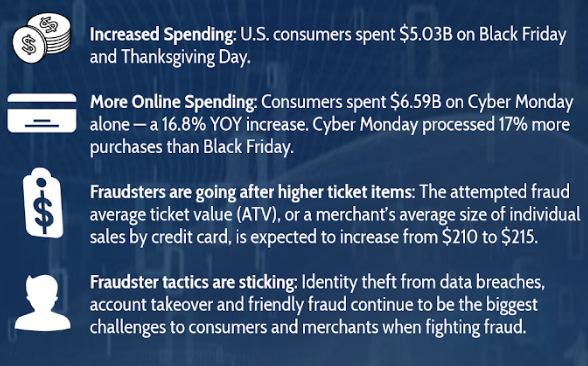

We'll report back after the holiday season and let you know how 2018's fraud figures stacked up. Here's a look into what 2017's figures looked like.

What We learned from 2017's holiday card fraud figures: