Originally Posted Jan 11, 2022 by Northwest Credit Union Association

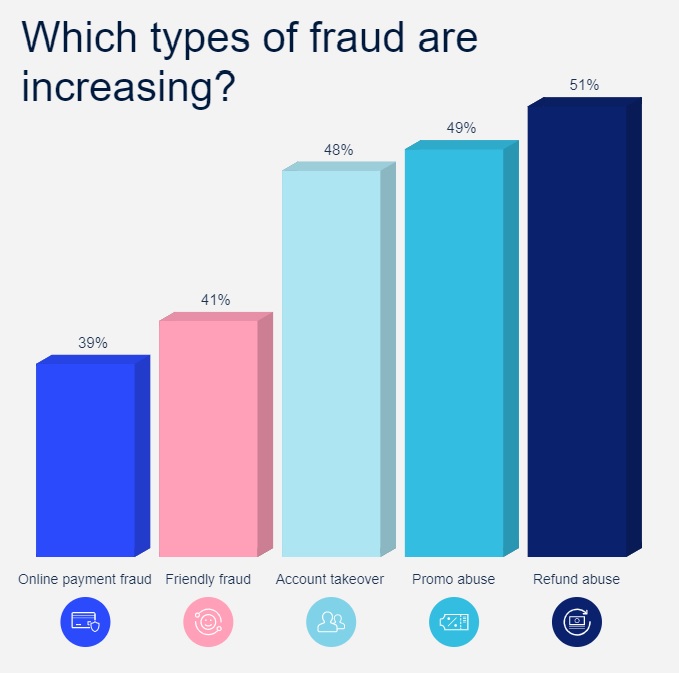

When it comes to preventing card fraud, issuers need all the help they can get. Fortunately, credit unions have access to a variety of tools, resources, and expertise in their fight against fraudsters’ ever-changing tactics.

Card not present (CNP) fraud is the dominant type of payment fraud that Strategic Link partner CO-OP Financial Services is seeing among its credit unions’ portfolios, comprising over 80% of fraud incidents across both debit and credit.

One key contributor to this rise has been the increasingly bold use of BIN attacks, one of the most common types of CNP fraud.